KY HCFA-1500 1990-2025 free printable template

Get, Create, Make and Sign hcfa 1500 form

Editing 1500 claim form online

How to fill out insurance claim form

How to fill out KY HCFA-1500

Who needs KY HCFA-1500?

Video instructions and help with filling out and completing hcfa 1500 insurance claim form

Instructions and Help about hcfa 1500 form printable

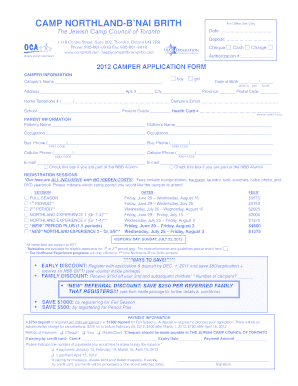

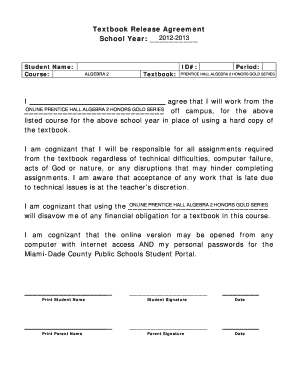

Welcome to go beyond learning experiences to code Metro our goal in creating this series is to provide you with tangible oftentimes little-known tips that you can apply to both your business and your career our topics will vary as will our speakers, and we welcome you to visit our website to get the latest edition of go beyond we appreciate your feedback and invite you to send us your thoughts and questions as well as any suggestions you might have for future topics our first edition of go beyond focuses on tips for completing the CMS 1500 form for faster payment our presenter today is our own chief operating officer Dr. Kim finger Kim has an extensive background in autism having served as a direct service provider in Connecticut many years ago after which she swayed into the world of executive coaching prior to joining code Metro Kim was the chief operating officer at autism spectrum therapies a large California-based autism services company Kim created the insurance billing department at code Metro and is here to share with you her tips on completing the 1500 form hello it's my pleasure to share with you our tips on how to successfully complete a CMS 1500 form a question were frequently asked by our customers is which fields on the 1500 form must be completed for the CMS form to be accepted and not rejected by the insurance carrier, so today we're going to answer this question as well as review which fields are optional to complete and which can be left blank we'll also be reviewing what information is entered in each of the mandatory and optional fields recognizing that the language on the 1500 form is foreign to most providers and a source of confusion when preparing the form okay let's take a look at the 1500 form there are 33 fields on the form of which two fields can always be left blank without worry and that's field 10d reserved for local use and field 15 if patient has had same or similar illness give first date now that we have those out of the way let's talk about the fields that must be completed to submit a clean claim before we go through the numbered fields let's start with entering the name and address of the insurance company in the top right-hand corner of the form, although you may be submitting the form electronically the name and address of the insurance carrier must be included in this space on the form itself field 1a is a required field in this field you will enter the patient's insurance policy number as indicated on their insurance card in some cases the card will be in the parents name and their policy number will be entered here the ID number though will reflect not the parent but the patient's insurance ID number fields 2 camp; 5 capture patient name and address and must be completed the only optional field is telephone number fields 4 camp; 7 will contain the same name and address as fields 2 camp; 5 although the name on the insurance card may be the mother or father's name recent changes dictate that the patient...

People Also Ask about blank hcfa form

What is the insurance claim form?

What is CMS 1500 insurance claim form?

What is the most common insurance claim form?

What are the types of claim forms?

What is the difference between UB04 and CMS-1500?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hcfa form pdf from Google Drive?

How do I execute hcfa 1500 health form online?

How do I fill out hcfa 1500 form on an Android device?

What is KY HCFA-1500?

Who is required to file KY HCFA-1500?

How to fill out KY HCFA-1500?

What is the purpose of KY HCFA-1500?

What information must be reported on KY HCFA-1500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.